· 4 min read

Whats In Your Mobile Wallet

Helping businesses forge stronger relationships with their employees, customers and fans through mobile wallet technology.

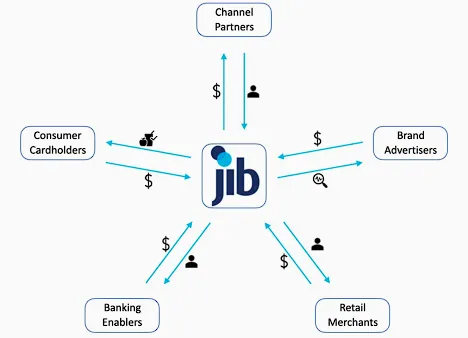

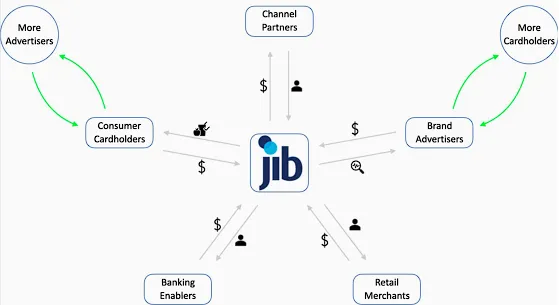

Jib is building a multi-sided marketplace of consumers, consumer brands, and merchants around the world.

Our tech stack is built around existing companies like VISA and MasterCard, and financial institutions like Sunrise Bank and other issuing banks in areas or regions where our business partners’ customers live and transact in the marketplace. We also utilize the services of various issuing processors to authorize and settle each transaction. In addition, Jib utilizes the mobile wallet technology of Apple, Google, Samsung, and others to deliver digital rewards in the form of prepaid cash on behalf of our brand partners to their loyal customers’ mobile wallets that can be redeemed for products or services anywhere that VISA and MasterCard are accepted all over the world whether online or in-store.

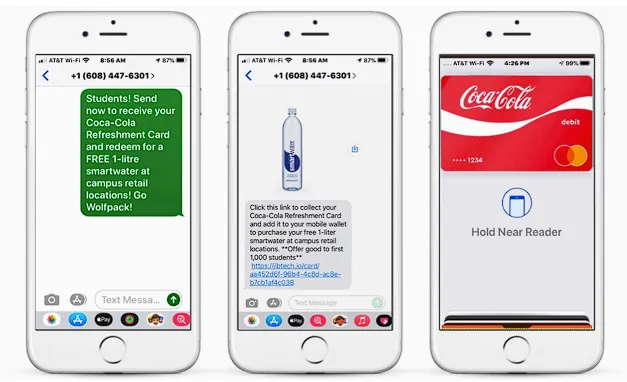

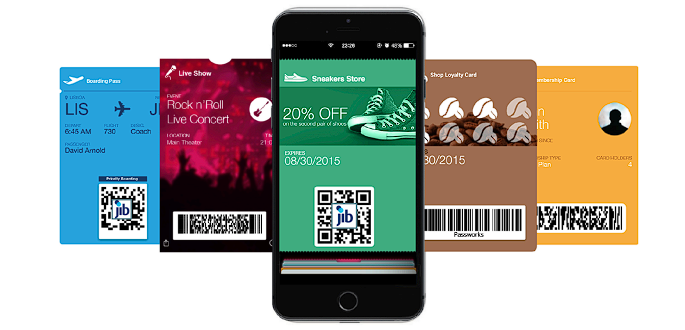

Several things occur when a consumer “opts-in” for a Jib reward. Jib issues a Virtual Prepaid MasterCard or VISA debit card with the appropriate cash preloaded to redeem the reward. The consumer adds the virtual card to their mobile wallet and redeems anywhere that mobile payments such as Apple Pay are accepted. This process generates revenue for Jib from the consumer brand, as well as a share of the interchange when the consumer redeems the offer at a merchant location while providing specific “free”products or services to the consumer. The consumer now has a free debit card in their mobile wallet that has all of the same features and functionality of a traditional “checking” account, the merchant gets a new sale, and the consumer brand giving away the “free” rewards is acquiring new customers, building brand loyalty and/or fostering retention. Jib’s “mobile wallet as a channel” solution also generates real-time zero and first party data that does not rely on third party cookies, which are now blocked by Apple and soon by Google, providing invaluable insights, data and analytics for our consumer brand partners.

In addition to earning fees from consumer brand partners and interchange when consumers use their Jib virtual prepaid cards to redeem rewards, Jib also acquires a new cardholder for our “neo-bank” business model every time a consumer opts-in for “free stuff” and a new virtual card is issued by Jib and loaded into their mobile wallet. Neo-bank focused FinTech companies like Chime and others are being valued in the market by an average of $1,160.00 per each cardholder. To give you an idea of the difference between how Jib acquires new bank accounts and Chime acquires new bank accounts, Chime’s average customer acquisition cost (CAC) is $45. Compare that to Jib’s negative CAC, as consumer brands pay Jib an average of 20% of the cash value (or $1 min.) loaded onto each Jib card to be used by the consumer to redeem their “free” product or service. Chime relies on interchange for more than 75% of their revenue and reportedly earns about 130 basis points of interchange on each dollar spent by their cardholders. Therefore, Chime cardholders must spend ~$77 for Chime to generate a single dollar in revenue from interchange fees. Jib cardholders merely have to “opt-in” to receive a reward, such as a “free” 1-liter smartwater from Coca-Cola in order for Jib to generate each dollar! Jib also earns a share of the interchange when our cardholders spend money via their Jib prepaid debit card. However, Jib cardholders do not have to spend any of their own money for Jib to still earn a single dollar. Jibbers merely have to “opt-in” to get “free stuff”.

In summary, Jib’s business leverages financial technology (FinTech) with an advertising revenue model more similar to Amazon, Facebook and Google, with interchange and enterprise SaaS revenue models as well. We utilize the established banking and debit card networks in our efforts to deliver prepaid cash rewards from consumer brands through our channel partners to millions of people — digitizing product trial and sampling, while fostering financial inclusion and equity.